10 Apr 2025 Uncertainty, Optimism, and Pausing Tariffs

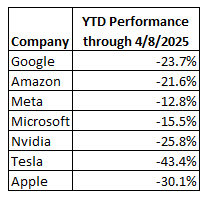

On December 31st, 2024, Karen Langley wrote a piece in the Wall Street Journal titled, “Stocks Cap Best Two Years in a Quarter Century,” which feels like it could have been written a quarter century ago. As I start to write this (it’s Wednesday morning), volatility has spiked to levels we haven’t seen since the COVID-19 pandemic or the Financial Crisis, the S&P 500 has fallen nearly 15% year-to-date, and the “Magnificent 7” stocks, which make up more than one-third of the index and are responsible for much of the positive performance during the last few years, have taken it on the chin:

The stock market’s reaction to President Trump’s tariffs has echoes of the early days of the pandemic: Confusion, worry, uncertainty, maybe even some anger. The echo that rings most clear, however, is the surprise of it all. Yes, there were rumblings in late 2019 and early 2020 about some weird virus in China, but no one anticipated a three-month stay-home order and years of public school closures. Similarly, the President had been very clear about his desire for tariffs, but the size and scope are greater than anticipated. Investors detest surprises, which is why, in both instances, the market sold off dramatically.

As you watch the impact on your portfolio, it’s normal to feel a host of emotions, but it’s crucial to not let them impact your behavior as an investor. If you are to take any advice, take it from Morgan Housel, who we refer to often, and who recommends that we “save like a pessimist and invest like an optimist.“

It’s a wonderful way to build a financial plan. Save in a way that acknowledges the good times won’t last, that you aren’t able to work forever, and at some point the party, your party, will stop. But invest with the confidence that the collective party will continue. Yes, there will be moments when the music stops, but eventually it will resume, and when it does, you want to make sure you’re still on the dance floor.

Right now, you may find it hard to invest this way, and I imagine it’s not because of what’s taken place over the past few days (I bet we’d all be fine if we knew the worst was over). What makes it difficult is the uncertainty, the not knowing if we’ve hit the bottom.

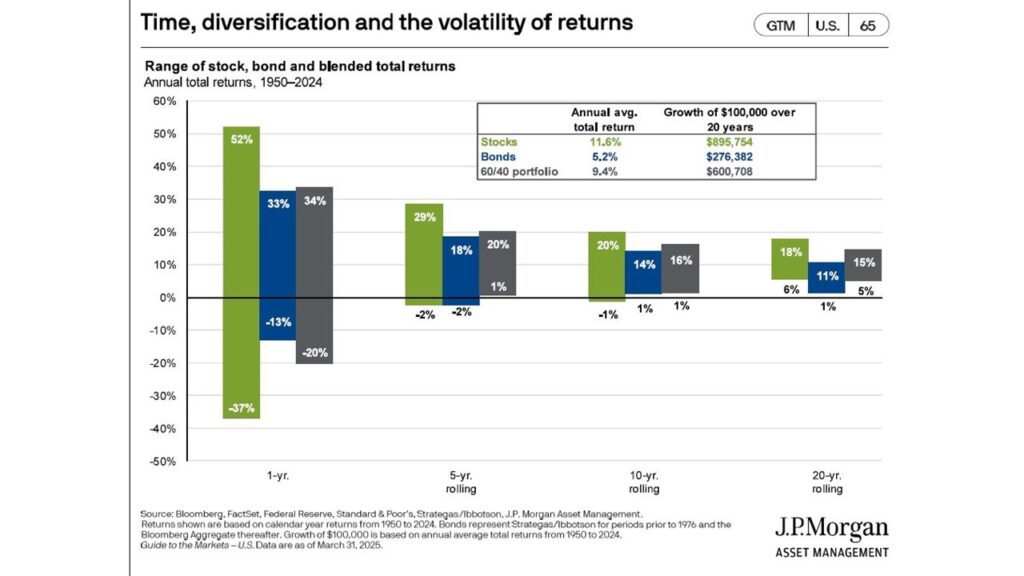

Yet, in the short-term, uncertainty and investing are intertwined. Below, you’ll see a chart from J.P. Morgan that lays this out:

The bars to the far left show the range of returns over any calendar year for stocks, bonds, and a portfolio that is 60% of the former and 40% of the latter. A dollar invested in the stock market on January 1st of any year could be worth as much as $1.52 or as little as $0.63 by the end of the year. It’s why we discourage investing money you’ll need within 4-5 years; the stock market is just too fickle.

However, stretch your time horizon a bit and certainty starts to appear. Whether 5 years, 10 years, or 20 years, a 60/40 portfolio has never lost money. We invest with this in mind, as optimists.

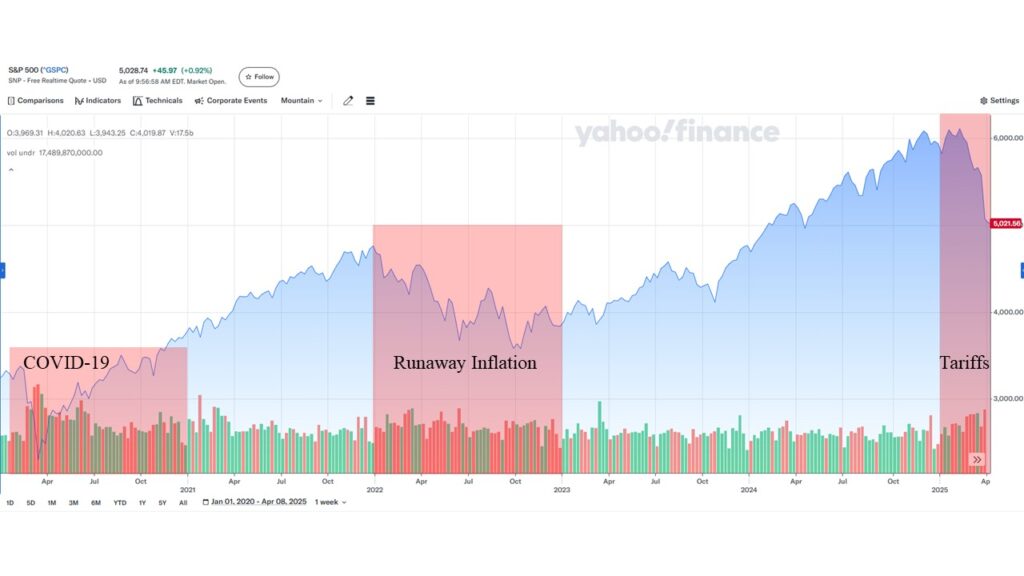

Earlier, I mentioned the current environment reminds me of the beginning of the pandemic. It’s hard to believe that was five years ago. There are times it feels like 50, and times it feels like yesterday. I find it both interesting and encouraging to see what the S&P 500 has done since it began. See below:

In short, the S&P 500 is up over 50% since the start of 2020, just before our economy shut down. The five years since have been somewhat extraordinary:

- COVID-19 Pandemic (2020): Second fastest bear market in history (19 days), stay-home orders, oil prices momentarily went negative, stocks fall more than 30% in less than a month, we’re all out in our driveways wiping down groceries.

- Runaway Inflation (2022, plus or minus a few months): Annual inflation (CPI) nearly hits double-digits, the Fed increases interest rates from 0.25% to 5% in 12 months, mortgage rates exceed 7%, bonds experience their worst calendar year in history.

- Tariffs (2025-?): Volatility spikes, stocks fall more than 10% in four days.

Again, despite all of this, the stock market is still up 50% in the last five years.

A few weeks into the pandemic, I wrote this:

It’s important to remember that, despite all the media noise, the economic releases, and the forecasts; at the core of it, you are investing in human enterprise and ingenuity. The market is a collection of well-capitalized companies run by smart, motivated, and creative people who find new ways to make profits no matter what economies, wars, and governments throw at them. You aren’t investing in a collection of companies as they are currently performing. Rather you are investing in the future earnings of tomorrow’s leading companies without having to guess who they are.

That’s how you invest like an optimist.

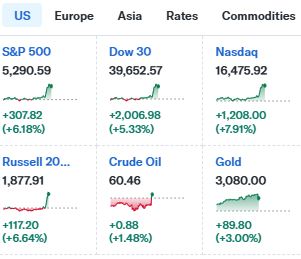

It’s now Wednesday afternoon at about 1:45 PM and the markets have suddenly done this:

Am I a little bothered that I spent a lot of time writing a Brief addressing tariffs only for the President to pause most of them for 90 days immediately after I finish? Of course not! (Maybe a little.) So, yes, invest like an optimist, but maybe the better advice I can give right now is to stop paying attention for a little while.

The content above is for informational and educational purposes only. The links and graphs are being provided as a convenience; they do not constitute an endorsement or an approval by Beacon Wealthcare, nor does Beacon guarantee the accuracy of the information.