07 Nov 2024 The President and the Stock Market

After a long and highly contentious election season, President Trump was declared the winner of the 2024 Presidential election early Wednesday morning. Now that we know who will take office in January, we can expect a lot of prognosticating about how it will impact the stock market. Even as I write this–it’s Wednesday morning–the S&P 500 is up 2%, the Dow is up 3.1%, and I can’t visit a financial website without reading something about the “Trump Trade.”

The simple truth about the President’s impact on the stock market is this: It doesn’t really matter who is in office. There are areas of life that the President impacts, obviously, but the stock market isn’t one of them. Let’s look at a few charts that support this.

First, as you can see below, since 1920, every President save three has enjoyed double-digit annualized returns throughout their tenure. Even when you include the three Republicans with negative returns, the average annual return for U.S. Presidential terms is 9.5%.

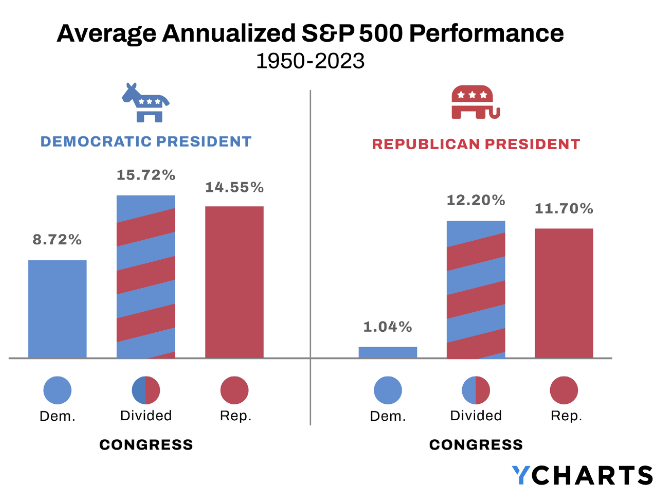

Second, our form of government offers checks and balances, so what happens when the data is broken down to include congress? Looking at a shorter time period (beginning in the 1950’s), we see similar performance:

While control of the House is still up for grabs as of the time I write this, Republicans will control the White House and the Senate, so we can focus on the two bars to the far right. Both offer investing outcomes we should be happy with. But, again, you can see that stocks perform well in most circumstances.

Looking at these charts, we can conclude one of two things: Either the President matters immensely and all have created a wonderful environment for investors, or the President matters very little and entrepreneurs and business leaders consistently find ways to create things that people want to buy no matter the political environment. Considering how differently each party approaches the economy, it’s clear that the latter is true.

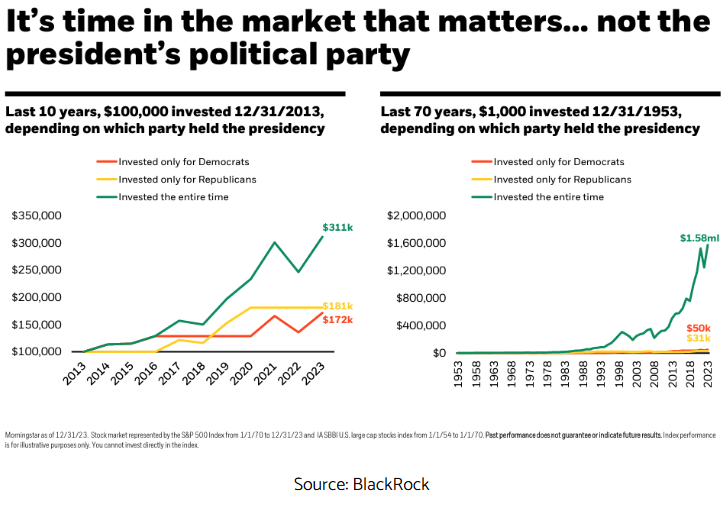

Politics can have a strong influence on investor behavior, if we let it. Let’s look at another chart, this one showing investors whose behavior is entirely dependent on whether or not their party holds the White House:

As you can see, letting politics influence your investment decisions is a clear impediment to a growing portfolio. Anecdotally, I’ve never met anyone with a strategy as clear-cut as this: all-in or all-out based on the Presidency. But the idea of taking short breaks from the stock market can creep into anyone’s mind. The challenge with this approach is never the exit, it’s the re-entry. Because if you exit and the market drops, the tendency will be to wait for it to drop more. If it rises, you’ll want to wait until it comes back to where you got out. As difficult as it can be sometimes, you are better served staying in the market. If you do make the decision to exit, it’s crucial to have an unemotional, objective framework that guides your re-entry.

There will be more to unpack as President Trump’s policies come into focus, particularly on the tax side. The Tax Cuts and Jobs Act (TCJA), passed during the first Trump tenure, will expire at the end of 2025. We can expect much of that to be extended, but he’s also signaled changes will be made. We will stay on top of it and keep you informed.

In closing, the data offers a compelling case that the President has little impact on the stock market, but we all know data does little to soothe the nerves. So if you’re feeling unsettled after Tuesday’s election, we hope you’ll reach out to us.

The content above is for informational and educational purposes only. The links and graphs are being provided as a convenience; they do not constitute an endorsement or an approval by Beacon Wealthcare, nor does Beacon guarantee the accuracy of the information.