16 Jan 2025 2024 Tax Forms You Might Expect To Receive

Tax season is upon us once again! The Internal Revenue Service recently announced that the 2024 tax filing season will officially begin on Monday, January 27, with returns due on April 15. On that Monday, the IRS will start accepting 2024 tax returns, marking the beginning of a season that, let’s be honest, doesn’t top anyone’s list of favorites. While other seasons—like beach season, holiday season, or football season—bring joy and anticipation, tax season is more about forms, deadlines, and a bit of financial reflection.

It’s tempting to dream of a world where tax filing is effortless—where the code is simple, refunds are immediate, and terms like “adjusted gross income” don’t exist. While we’re not there yet, here at Beacon, we’re committed to making the process as smooth and stress-free as possible. That means working to minimize your tax bill and helping the entire experience feel, if not fun, at least straightforward.

To help you prepare, we’ve created a helpful guide summarizing the tax forms you might expect to receive based on your accounts and strategies. It’s designed specifically for our clients, but even if you’re not with Beacon, it’s a great starting point to tackle this important season with confidence.

Forms You Might Receive from Charles Schwab

1099-INT or 1099-DIV: If you earned interest or dividends from investments in a taxable (non-retirement) brokerage or trust account, you should receive a Form 1099-INT and/or 1099-DIV.

You’ll also receive a 1099-INT if you earned interest on savings, money market accounts, or CDs.

1099-B: If you or your advisor sold investments in your brokerage account or owned certain mutual funds, you’ll receive a 1099-B. This form includes details of securities sales, such as purchase dates and costs.

Tax-loss harvesting transactions will also appear on this form, though charitable stock gifts won’t. Be sure to keep records of charitable donations, including acknowledgment letters and brokerage statements.

If your accounts are with Charles Schwab, you’ll receive a Form 1099 Composite and Year-End Summary Report, which consolidates your 1099-INT, 1099-DIV, and 1099-B forms. Schwab expects to post or mail these documents by February 14, 2025.

1099-R: If you took distributions (including Required Minimum Distributions) from retirement accounts such as a traditional, SEP, or Roth IRA, or from a pension or annuity, you’ll receive a 1099-R.

If you rolled over funds from a 401(k) or similar plan to an IRA, you’ll also receive a 1099-R, though direct rollovers aren’t taxable.

If you completed a Qualified Charitable Distribution (QCD), note that while QCDs appear on your 1099-R, they aren’t specifically identified as tax-free transfers. When filing, report the total distribution on line 4a of Form 1040, the taxable amount on line 4b, and note “QCD.” Retain charity acknowledgments for your records.

5498: If you contributed to a traditional, SEP, or Roth IRA in 2024, Schwab will file this form with the IRS. You might not receive a copy until May 31, 2025, but keep it for your records.

Backdoor Roth Contributions:

If you made a backdoor Roth IRA contribution, you’ll receive a 1099-R (for the conversion) and a 5498 (for the contribution).

These forms won’t come from Charles Schwab but are common, too…

SSA-1099: For Social Security benefits received.

1099-S: If you sold real estate in 2024.

5498-SA and 1099-SA: For health savings accounts (HSAs), reporting contributions (5498-SA) and distributions (1099-SA).

Schwab’s 1099 Dashboard

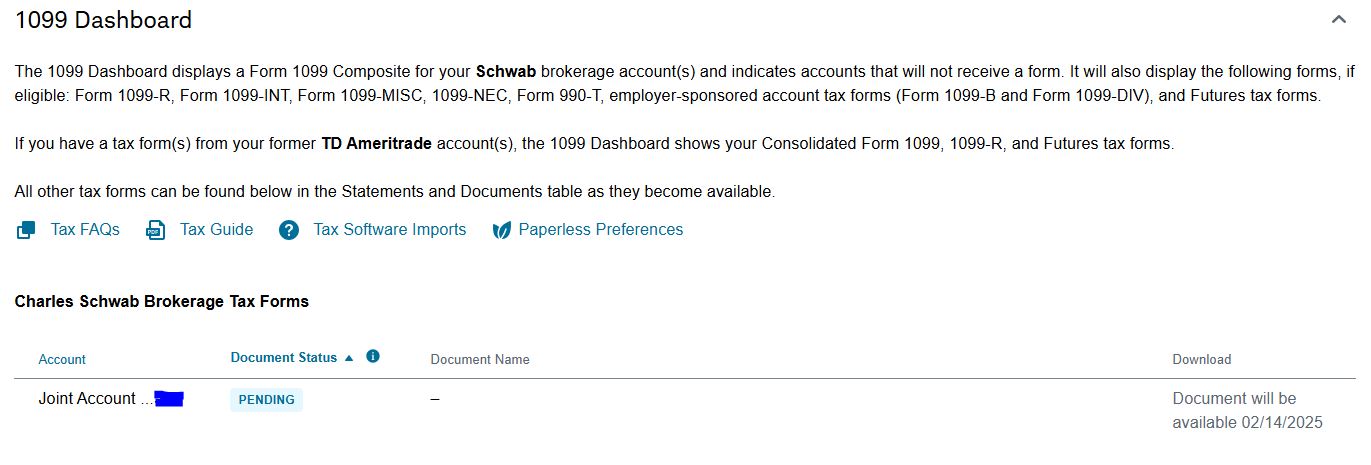

If you have an account with Charles Schwab (through Beacon or otherwise) you have access to a handy tool called the 1099 Dashboard. It’s located on their website and you can access it by logging into your account and clicking on “Accounts” and then “Statements and Tax Forms.” I like Schwab’s dashboard because it shows the tax forms you can expect along with their expected availability dates. Below is a snapshot of my 1099 Dashboard. Crystal and I will get a Form 1099 Composite and Year-End Summary Report for our brokerage account but no 1099-R since we didn’t take a distribution from a retirement account. You can check out your own 1099 Dashboard by clicking here to log into your Schwab account.

Final Thoughts

Organizing your tax documents early and sharing them with your tax preparer (if applicable) can make the process smoother. While this summary highlights common forms, there may be others specific to your financial situation.

We hope you find this guide helpful! If you have questions or need assistance as you prepare your 2024 taxes, please don’t hesitate to reach out.