22 Jan 2026 What Tax Forms Should You Expect To Receive?

The IRS has announced that the 2026 filing season, covering 2025 income, will officially open on Monday, January 29, 2026. We all dream of a world where filing taxes is effortless: simple rules, instant refunds, and no one ever saying “adjusted gross income.” While we’re not there yet, here at Beacon, we’re committed to making your experience as smooth and stress-free as possible. Our goal is to minimize your tax bill while making the filing process clear and manageable.

To help you prepare, we’ve put together a guide outlining the tax forms you can expect to receive based on your accounts and financial planning strategies. It’s created for Beacon clients, but it’s a useful resource for anyone navigating this year’s filing season.

Forms You May Receive from Charles Schwab

1099-INT / 1099-DIV

Issued if you earned interest or dividends in a taxable (non-retirement) brokerage or trust account.

You’ll also receive a 1099-INT for interest earned in savings accounts, money markets, or CDs.

1099-B

Issued if you (or we, on your behalf) sold investments in your taxable brokerage account or owned certain mutual funds.

This form reports details on securities sales, including cost basis and holding periods. Also of note:

- Tax-loss harvesting transactions will appear here.

- Charitable stock gifts will not appear—be sure to keep acknowledgment letters and brokerage statements.

- Schwab provides a Form 1099 Composite and Year-End Summary Report, which consolidates your 1099-INT, 1099-DIV, and 1099-B.

- Schwab expects to post or mail these by February 13, 2026.

1099-R

Issued if you took distributions—including Required Minimum Distributions (RMDs)—from Traditional, SEP, or Roth IRAs, or from pensions or annuities.

You’ll also receive a 1099-R for rollovers from employer plans, though direct rollovers remain non-taxable.

For Qualified Charitable Distributions (QCDs):

Your 1099-R will show the full distribution amount without identifying the QCD portion.

When filing:

- Report the total on Form 1040, line 4a

- Report the taxable amount on line 4b (total amount – the QCD amount)

- Write “QCD” next to it

- Keep charity acknowledgments for your records.

Form 5498

Issued for IRA contributions (Traditional, SEP, or Roth). Schwab files this with the IRS, and you may not receive a copy until May 31, 2026. Keep it for your records.

Backdoor Roth Contributions

If you completed a backdoor Roth IRA contribution:

- You’ll receive a 1099-R (for the Roth conversion), and

- A 5498 (for the nondeductible Traditional IRA contribution).

Other Common Forms (not from Schwab)

- SSA-1099: Reports Social Security benefits received in 2025.

- 1099-S: Issued if you sold real estate.

- 5498-SA / 1099-SA: For HSA contributions (5498-SA) and distributions (1099-SA).

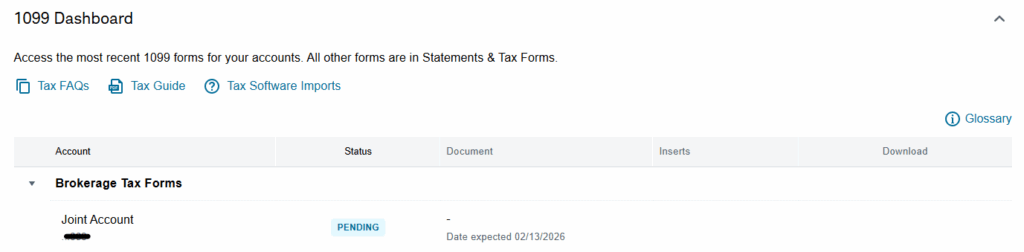

Schwab’s 1099 Dashboard

If you hold accounts at Charles Schwab, their 1099 Dashboard is a helpful tool. After logging in, find it under Accounts → Statements and Tax Forms. It shows the forms you can expect and their estimated availability dates.

For example: Crystal and I will receive a Form 1099 Composite and Year-End Summary Report for our taxable account but no 1099-R since we didn’t take any retirement account distributions. You can check your dashboard anytime to see what’s coming and when.

Final Thoughts

Getting organized early and sharing documents promptly with your tax preparer, if you work with one, can make a big difference. While this summary highlights the most common forms, your specific situation may require additional items.

We hope you find this guide helpful. If you have questions or would like support preparing your 2025 returns, please don’t hesitate to reach out.