07 Aug 2025 The Perfect Time to Invest

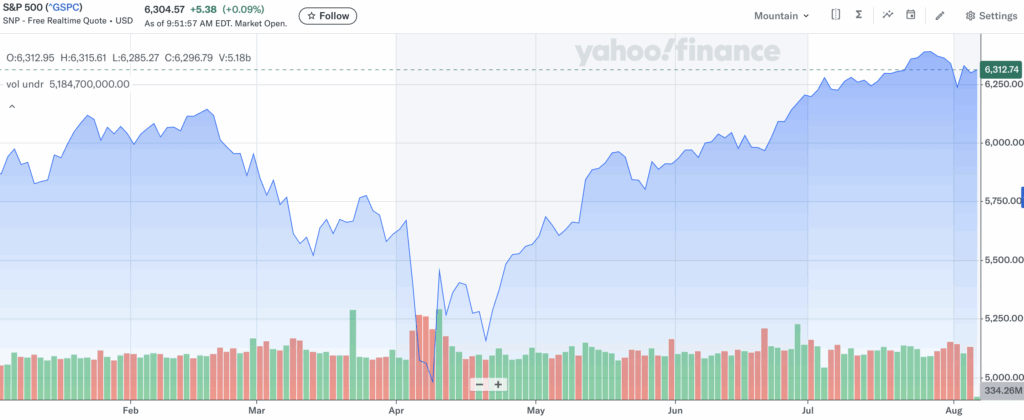

The S&P 500 has covered a lot of ground this year. After rising more than 4.5% through the first seven weeks, it stalled out as investors braced themselves for President Trump’s early-April tariff announcement. As we all remember, the tariffs were significantly higher than expected, triggering a dramatic sell-off of more than 12% between April 2nd and April 8th. Within a month, however, the market had fully recovered. The upward trend then continued, leading us to where we are now: up more than 7% through August 5th.

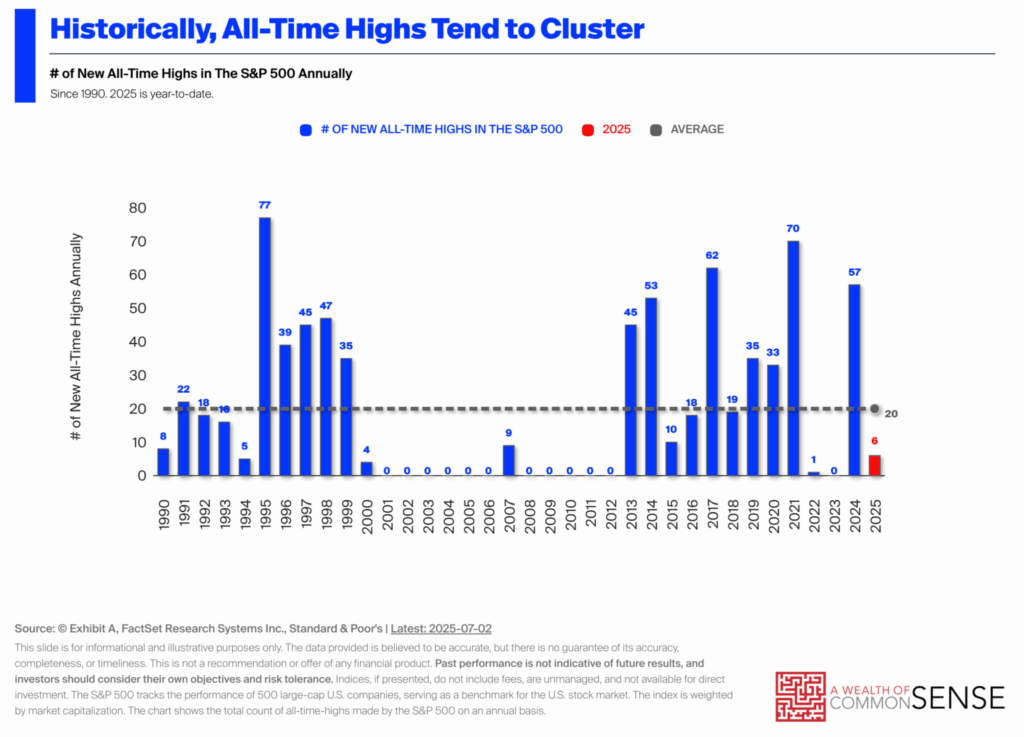

As it’s traversed a volatile path, the S&P 500 has set a number of all-time highs; more than 15, at last count. While that might seem like a lot, it’s actually quite common: since 1990, the market has averaged 20 new highs each year.

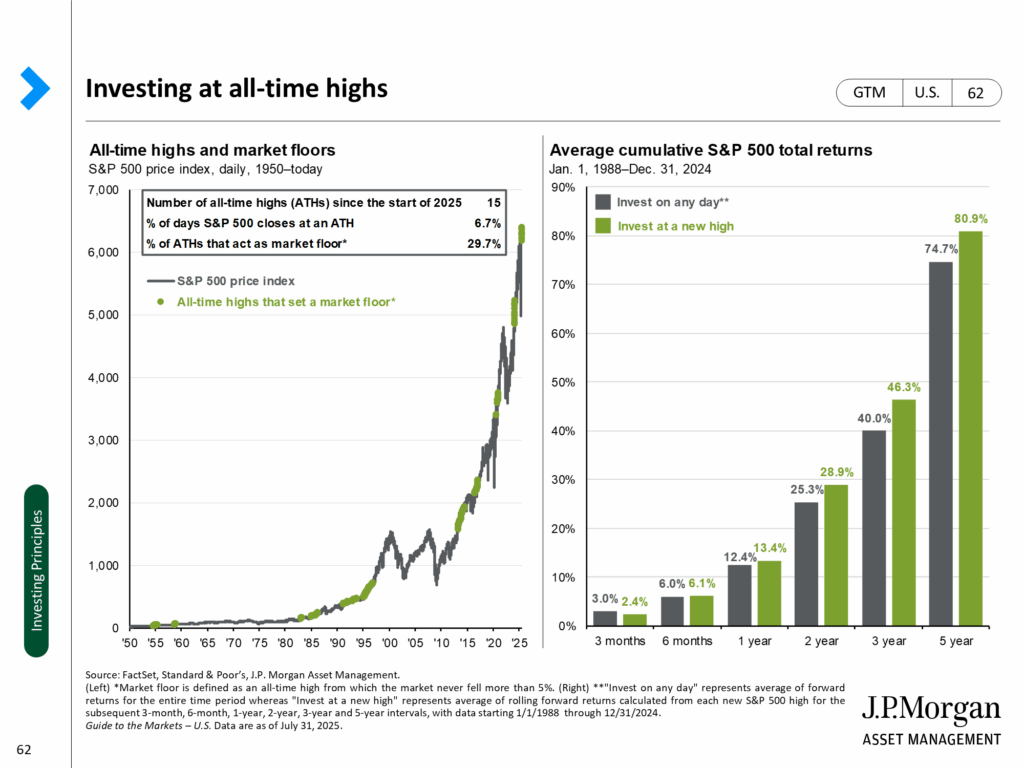

Of course, the financial media loves talking about this stuff. Within the last month, the Wall Street Journal alone has published seven articles on the subject, and all the commentary causes us to ask a very normal, very rational question: If the stock market is so high, should I keep investing? Surprisingly, the data tell us it might be the perfect time to buy:

Focusing on the chart on the right, which runs from January 1st, 1988 through December 31st, 2024, we see that over various rolling time periods, buying when the stock market makes a new all-time high yields better returns than buying on any given day. This seems counter-intuitive because our gut tells us a high stock market only has one way to go–down–but it discounts the impact of momentum: new highs tend to beget more new highs. You can see this in the previous chart.

The title of today’s Brief is (a little) tongue-in-cheek. I don’t know if this is really the perfect time to invest, but seeing this data does reinforce my belief that for those still saving and accumulating, the stock market doesn’t present an inopportune time to buy. Life circumstances might necessitate a pause–job loss, change in goals, a period of higher spending–but whether the stock market is up, down, or somewhere in-between, the long-term investor is typically best served by tuning out the noise and investing according to their financial plan.

The content above is for informational and educational purposes only. The links and graphs are being provided as a convenience; they do not constitute an endorsement or an approval by Beacon Wealthcare, nor does Beacon guarantee the accuracy of the information.