29 May 2025 It Takes a Scammer

There was an early 2000s TV show on Discovery Channel called It Takes a Thief – the premise being that two former thieves show homeowners how easy it is to break into homes by literally breaking into their homes while they watch. Surprisingly, this reality show concept didn’t last long, but the idea is intriguing. Sometimes, it can take a thief to show you how to break into a house to cause you to make the necessary changes to stop them in the future.

In the financial world, you have likely seen a number of emails from your bank or other companies related to protecting yourself from financial scams. It has become so prevalent that many websites now give warnings at the top of every page! It makes sense why – per the FTC, “in 2023, 27% of people who reported a fraud said they lost money, while in 2024, that figure jumped to 38%.” This is a real issue that has the potential to impact all of us at some point.

In a similar vein to the TV show, I think to prevent ourselves from being scammed we need to, in some way, start thinking like scammers. What would they be after? What information are they trying to obtain? How would they go about tricking an unsuspecting victim?

I wanted to quickly walk through an example of a scam that I recently experienced to use as a springboard to think about the general patterns to be aware of.

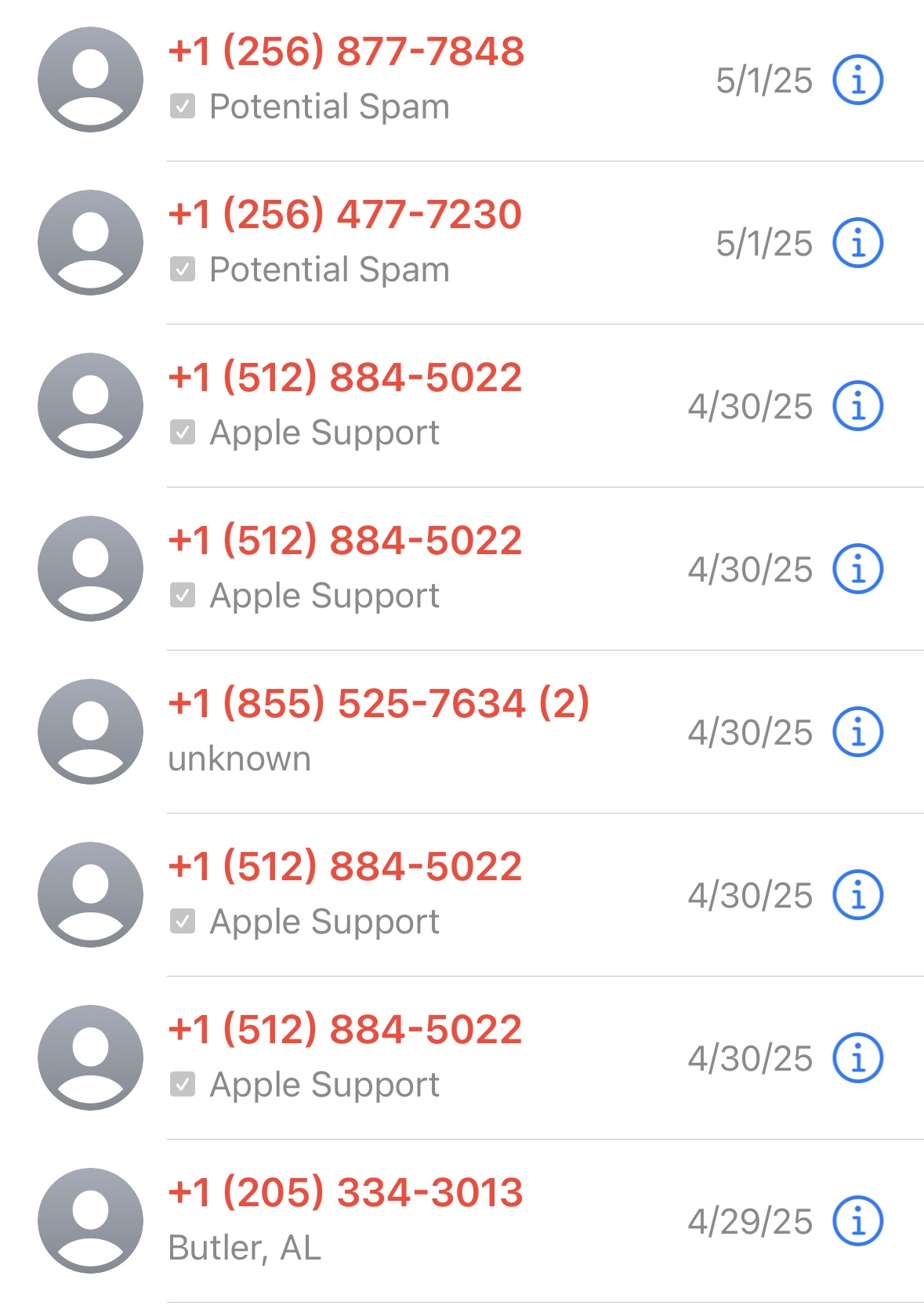

If you are like me, your recent phone log likely looks something like this:

It is seemingly common to get more spam calls than normal phone calls on a daily basis!

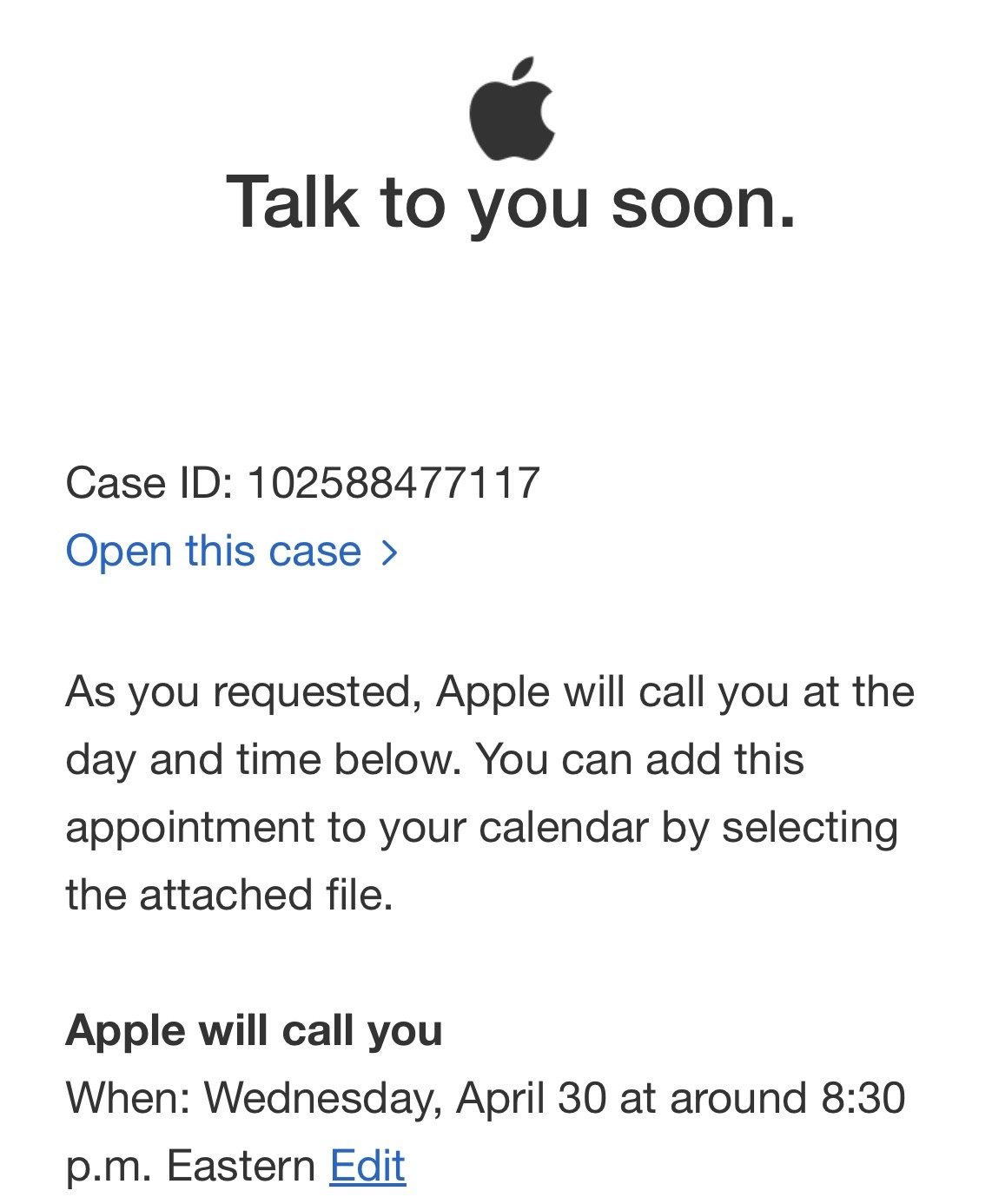

You may notice in the picture above that I received a phone call from Apple Support. It even has the check mark to show that it is a verified number! Well, earlier that day I also received the following email:

Similar to the phone call, this was a verified Apple Support email. The problem is that I had not scheduled a phone call with Apple Support. With my security awareness raised, I started to think about what could be going on. I went to the Apple App Store and downloaded the official Apple Support app. I chatted with them and explained my issue – I received this legit seeming email, but I didn’t schedule anything. They confirmed that the Case ID was a real Apple Support one, but it was not tied to my iCloud account. They told me that if I received a call that I did not initiate to not answer.

Several hours later the scam started to show up – just before the given time, I received a call from an unknown number. I didn’t answer, but they left a message as if they were Apple Support. A few minutes later at the appointment time, I received a phone call from the actual Apple Support team. It seems that the scam attempt was for me to be aware of a phone call coming from Apple Support (with the legit looking email) and then call me to steal information when I was expecting Apple. Thankfully, I avoided the scammers for now, but I imagine it will continue to be harder to perceive in the future. How can we begin to think like scammers to ultimately protect ourselves?

Most scams revolve around two desires by the people committing them – they want information from you, or they want you to do something.

There are several ways to protect your information:

Do not share personal information with someone that calls you. This includes multifactor authentication codes. If you get a call from someone claiming to be Social Security, the IRS, a bank you use, or any other business, do not give them information voluntarily. If you think it is a real call, you can always hang up and call the actual number for those entities. None of these companies will call you unannounced and ask for your information.

Consider freezing your credit to protect your Social Security number from being used.

Do not open links in email or texts if you do not know the sender or were not expecting any message.

Utilize a password manager to give you complex unique passwords for each site you visit.

Questions to ask before doing something someone asks:

Did I initiate the action or did someone else do so unannounced? For instance, if you receive a spam text about an unpaid toll, think about if you even ever went through a toll!

Does the correspondence come from a trusted source or is it written with grammatical errors? These are big signs that something is a scam.

Do I know the person that I am talking to on the phone or online? Romance scams and pig butchering scams are common and are often the result of talking to someone for an extended period of time that you are not sure is who they say they are.

Through any type of potential scam, a big piece of advice is to talk with someone you trust. If you are concerned about something seeming off, ask a trusted friend or family member what they think about the situation. Do this before you decide to pay for something or transfer money – sometimes it is too late at that point. Scammers love to make you think what is happening is urgent, but it rarely is. Even the IRS gives you time to pay money back!

At Beacon, we unfortunately hear stories all the time about people losing money or their identity to scams. The reality is that some of them are very sophisticated and can be hard to perceive. At the end of the day, stay aware and slow down before making a decision. As always, we are happy to discuss if you ever have any concerns about this topic – we have more resources that we can provide!

The content above is for informational and educational purposes only. The links and graphs are being provided as a convenience; they do not constitute an endorsement or an approval by Beacon Wealthcare, nor does Beacon guarantee the accuracy of the information.