20 Feb 2025 FIYA, not FIRE

I suspect most of our readers know of the FIRE acronym – Financial Independence, Retire Early. I came across a recent Pew Research report that discussed how the age of young adults reaching financial independence from their parents is shifting later, so thought this week’s brief would explore a different take on FIYA – Financial Independence for Young Adults.

Some key takeaways from the section on financial help and independence:

“45% of young adults say they are completely financially independent from their parents. Among those in their early 30s, that share rises to 67%, compared with 44% of those ages 25 to 29 and 16% of those ages 18 to 24.

44% of young adults say they received financial help from their parents in the past year. The top two areas in which they got help were household expenses and their cellphone bill or subscriptions to streaming services.

Among parents who say they helped their children financially in the past year, 36% say doing so has hurt their personal financial situation at least some. This is especially the case among parents with lower incomes.

Most young adults who live with their parents say they contribute financially, including 65% who say they pay for household expenses such as groceries or utility bills and 46% who say they contribute money toward the rent or mortgage.”

The young adult age range here is from 18-34, so I’m glad they provided the percentages of smaller age bands to separate out college aged young adults. So 54% of young adults from ages 25-29 and 33% from ages 30-34 are not financially independent from their parents. Plus, some parents are making sacrifices for their own financial situations in order to continue helping.

We regularly work to help clients with children plan for education goals and legacy goals (gifting during life and/or at death). Some help their children get started with investments through vehicles like a custodial investment account or helping children set up a Roth IRA or Traditional IRA, once they have earned income. It may not even be your goal to have children fully financially independent, if gifting legacy goals during life is an important goal to you. Or there are factors like disabilities that make full independence difficult. While planning, we often have to consider what trade-offs you are willing to make in your financial plan trajectory for the level of support you want to provide.

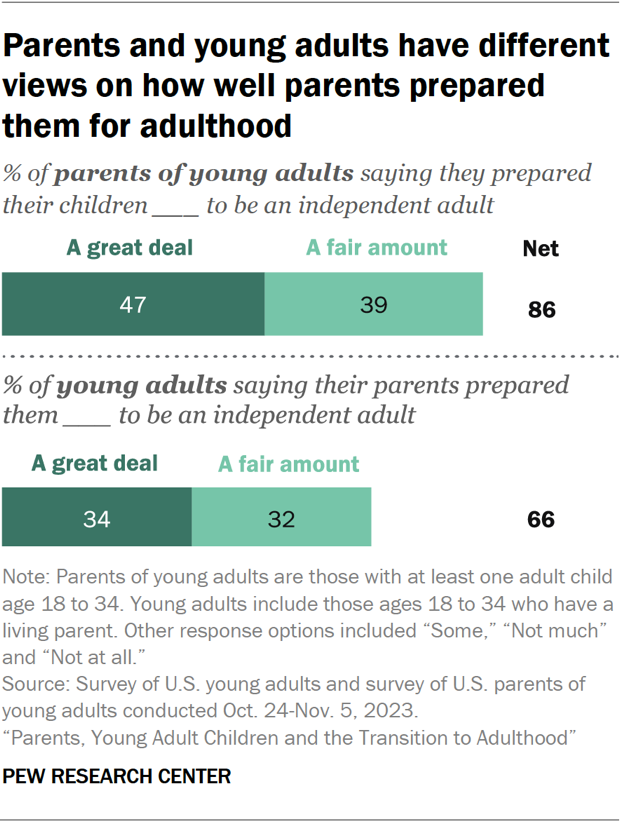

The Pew Research report also included this chart, which shows how well parents and children thought their parents did in setting them up for independence.

Looking at this chart, I wonder whether the kids may be somewhat oblivious to the ways that their parents are helping prepare them to be on their own (I can’t speak for everyone – but my high school self is raising my hand here!). Some ways are more obvious, like paying tuitions or other bills, but there are some other less obvious ways to help practically set up kids for success.

Below are just a few additional ideas to consider, outside of direct monetary support.

Powers of Attorney: At age 18, kids are legal adults and need their own Health Care Powers of Attorney and Durable Powers of Attorney. Even if they are still 100% financially supported by you, these documents allow parents to make medical and financial decisions on their behalf if needed. I hope they never need to use them, but you’d rather have them than find yourself in a situation without them. As they move through adulthood, they can revisit and amend the named individuals in their documents.

Freeze your child’s credit: Children under 18 normally do not have credit reports, but by proactively freezing their credits, you can help ensure there is not unauthorized activity associated with their personal information. This is free to do and does not impact your credit score. More details on the process can be found here. You want to do this at all three national credit bureaus. (And if you have not yet done this for yourself, this is a reminder for you, as well!) You can also set up fraud alerts. Once they are 18, you can pass the reins over and teach them the practice of checking for your annual free credit report and how to freeze/unfreeze your credit when needed.

Health insurance: Children can stay on parents’ health insurance until they turn 26. If this is a way you want to and can continue to support them, by all means, do it! Perhaps involve them in the decision, and help compare the costs between joining a new employer’s plan (if benefits are offered), getting a plan on the marketplace, or staying on your plan.

Workplace retirement plans: More 401(k)s offer Roth options now and for many young adults, that may be a more appealing option than pre-tax contributions. You can help them navigate enrollment and encourage contributions, even if just by starting with a small amount. Build the practice from day one if possible. And, check to ensure there are beneficiary designations!

Organization in YOUR financial life: Having your finances organized and consolidated is one of the best gifts you can give to those who will eventually need to help you with finances. Revisit your own estate planning documents and try to include clear language and instructions, especially if your estate is more complex. Communicate where your planning documents are located so it’s easy to find in the event of someone needing to assist you. Consolidating accounts as much as possible helps the eventual transfer of assets to heirs, too.

Regardless of whether full financial independence from you is your goal, hopefully there are steps you can take to foster a curiosity in finances and have healthy conversations about them. And as always, we are here to help you navigate these conversations and decisions in your life.

The content above is for informational and educational purposes only. The links and graphs are being provided as a convenience; they do not constitute an endorsement or an approval by Beacon Wealthcare, nor does Beacon guarantee the accuracy of the information.