06 Nov 2025 Advice from The Beanie Baby Handbook

On a recent trip to my parents’ house, I found The Beanie Baby Handbook – 1998 Edition, available exclusively through Scholastic school markets. This unofficial guide packs in collector tips, trivia, and a directory of the current and retired collections.

Like any good investment prospectus, this guide provided kids and their parents with everything they need to make what seems like a well-informed decision about their next purchases, or, as the authors believed, investments. It detailed the total number produced for each style, the current price, and best of all, a ten-year projected value for 2008.

Were you lucky enough to have a mint condition Brownie the Brown Bear? It was issued in 1993 for $5, valued at $1,200 in 1998, and projected to be worth $5,000 in 2008! And like many prospectuses, those projections proved wildly optimistic. I share these stats somewhat in jest, but many attics are filled with boxes of toys people believed could “really be worth something someday.” You can’t always believe everything you read in a prospectus. However, buried in the handbook’s introduction is a small nugget of investment truth amid all some other nonsense:

“Basically, if you can afford to do this, simply putting away five or ten of each and every new Beanie Baby in super mint condition isn’t a bad idea… you just might wind up with a few big winners.”

Diversification – a word so often said that it may sound like only noise. Just as collecting every Beanie Baby increased your odds of owning a valuable one, investing broadly increases your odds of owning the next big winner in the stock market without having to predict which one it will be.

So many investments and ideas are competing for our time, attention, and money, that diversification can start sounding simplistic, and even too simple. The fears creep in. Am I missing out on something better? Is it too late to join the craze? What if I sell something and the next day, it’s a meme stock that goes to the moon? A diversified portfolio may be simple on the first glance but there is more than meets the eye.

Much like chasing the next collectible craze (Labubus, anyone?), investors are tempted to try to pick the next big stock or use active investment managers attempting to beat the indices. Many investment portfolios are filled with one off positions or strategies that were pitched as something that can do better than the market. Sometimes they do just fine. The mediocre performers or the super-performers are the places we have the most tension when deciding to change course. Sometimes we need the space back (in the attic or your portfolio) so those funds are better positioned for current use or long-term goals. Or when you have a big winner (maybe someone really will still buy Brownie the Brown Bear on eBay for $3k), it’s time to say “I won!” and take the win while you have it, forgoing the woulda coulda shoulda thoughts.

Unlike betting on a single collectible, stock, or even a strategy, a diversified approach offers a safer path. When you own the market through broad Exchange Traded Funds, you’re essentially saying, “I’ll take some of everything.” A fund like the Vanguard Total Stock Market ETF (VTI) owns nearly 4,000 U.S. companies. If you look at the list of holdings (linked here), you’ll see all the names you recognize, like Apple, Nvidia, Microsoft, to smaller, lesser-known firms you’ve probably never heard of.

With that single ETF, you own a slice of the entire US economy. VTI is market-weighted, so you own a proportional amount of securities that makes up the market. If you own $100,000 of VTI, about $6,700 of that is invested in Nvidia (as of September 30, 2025). Even five years ago, Nvidia made up a negligible percentage of that fund. As the stock’s market weight grew, so did the fund’s allocation to the stock. And you didn’t have the responsibility of deciding when to purchase the investment! You capture the growth of companies that rise to the top without attempting to predict the specific winners, and avoid the heartbreak of betting your savings on the equivalent of a retired platypus.

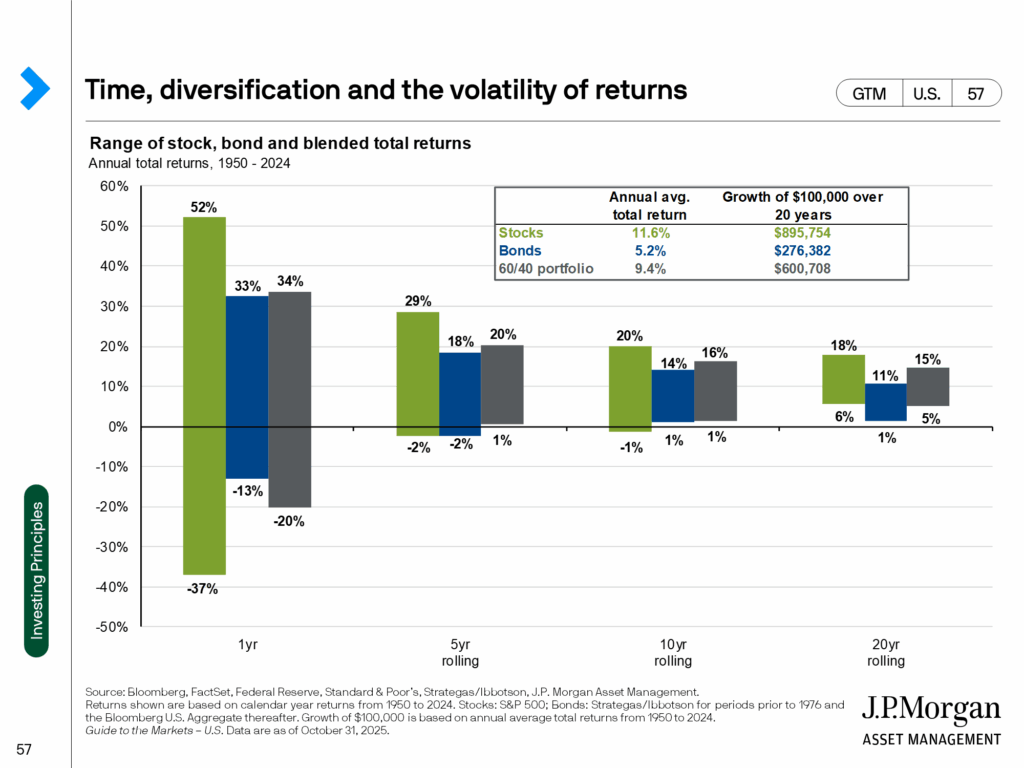

Historically, that broad exposure has paid off. Over the last 20 years, the total U.S. stock market has returned around 8–9% per year on average, despite recessions, pandemics, and market manias.

We’ve probably shown a version of this chart before, so forgive the repetition, but the point bears repeating. A diversified portfolio that remains invested in the market over the long-term, avoiding attempts to market time, achieves the total average return that offers an ample inflation adjusted rate of return.

Sadly, for all of us with boxes in the attic, Beanie Baby collectors didn’t have the same luxury. Sure, you may have been diversified across your collection of Beanie Babies, but the collection did not prove a lasting market. The handbook also alludes to an important detail we take for granted – the ability to invest for the future is a privilege to begin with. Maybe some decent investment advice was buried in the handbook after all.

The content above is for informational and educational purposes only. The links and graphs are being provided as a convenience; they do not constitute an endorsement or an approval by Beacon Wealthcare, nor does Beacon guarantee the accuracy of the information.